What is an Investment Fund?

An investment fund is a pool of capital belonging to numerous investors that is used to invest in securities like stocks, bonds, and other assets. Each investor in the fund retains ownership and control over a certain number of shares in proportion to the amount they invested.

Investment funds allow investors to hand over control over tasks such as portfolio allocation and liquidity management to a professional in exchange for a fee.

Techopedia Explains the Investment Fund Meaning

An investment fund is a financial vehicle that gathers money from investors to collectively purchase a diversified portfolio of securities and other assets. It serves as an indirect way for investors to access various financial markets and investment opportunities that may be difficult to obtain individually.

Investment funds are managed by professional fund managers who make investment decisions based on the fund’s stated objectives and strategies. The fund’s assets are held by a custodian for safekeeping on behalf of the investors.

The key benefits of investment funds include professional management, diversification, economies of scale, liquidity (for open-ended funds), and access to a wide range of investment opportunities. However, funds also come with fees, potential underperformance risks, and a lack of direct control over investment decisions.

How Do Investment Funds Work?

Now that we have explored the definition of investment fund, it is time to learn how these financial vehicles work. Basically, they raise money from a group of investors and use it to build a portfolio of financial instruments aligned with the fund’s strategy and objectives. These investments are selected and managed by seasoned professionals.

When you invest in a fund, you buy shares or units that represent ownership in the fund’s holdings. The value of the shares will fluctuate based on the performance of the investments that make up the fund’s portfolio.

As an investor, you do not have direct control over which assets the fund buys or sells.

The fund manager oversees the portfolio, conducting analysis and research to decide which investments to include and in what quantities. They determine when to buy or sell based on the fund’s goals. The manager’s investment decisions aim to produce returns for investors while adhering to the fund’s risk parameters.

In exchange for this professional management, funds charge fees and expenses that are deducted from its total assets. These include management fees paid to the advisor as well as operational and transaction costs.

The fees reduce the fund’s net returns but provide convenient access to skilled investment management.

Open-End vs. Closed-End Funds

Open-End Funds

These funds continuously issue new shares to investors and redeem shares from existing investors. They are priced based on their net asset value (NAV) at the end of each trading day. Since new shares can be created as needed, the fund’s share price closely tracks its NAV.

Open-end funds only trade once per day after the market closes. Investors buy and sell shares directly with the fund company at that day’s closing NAV price. This provides predictability in pricing but limits trading flexibility.

A key advantage of open-end funds is the high liquidity of their shares since the fund can readily issue new shares if capital inflows increase. However, they must hold some cash reserves to handle redemptions, which reduces the amount that the fund invests in financial assets.

Most mutual funds and exchange-traded funds (ETFs) are structured as open-end funds. According to data from Statista, there are more than 130,000 different open-ended funds registered worldwide.

Closed-End Funds

These funds have a fixed number of shares that are traded on exchanges like stocks. Their prices fluctuate based on market supply and demand, allowing them to trade at premiums or discounts to their NAV from time to time. Closed-end funds do not redeem shares like open-end funds.

Since closed-end funds trade throughout the day like stocks, investors can capitalize on intra-day price movements. However, the closed nature means that the fund cannot easily raise new capital to invest.

Closed-end funds can remain fully invested without cash drag since they don’t have to set aside reserves to cover redemptions. This also allows them to invest in less liquid alternative assets like private equity.

Their structure allows the fund to use leverage and complex strategies involving options, futures, and short-selling more easily than open-end funds. Data from the Investment Company Institute (ICI) indicated that $252 billion was invested into these funds by the end of 2022.

When investors identify a fund trading below its NAV, they can take advantage of that opportunity as long as they believe that the underlying assets will increase in value in the foreseeable future. Meanwhile, funds that are trading at a premium – that is, above their NAV – may prompt investors to sell their holdings as they believe they can repurchase the shares at a lower price later on.

Some key advantages of closed-end funds include tax efficiency, the ability to remain fully invested, flexible investment strategies, and trading opportunities from pricing inefficiencies. However, liquidity risks are present if the demand for the fund’s shares dries up.

Types of Investment Funds

Understanding the meaning of investment fund is important as different institutions and financial vehicles fall into this category.

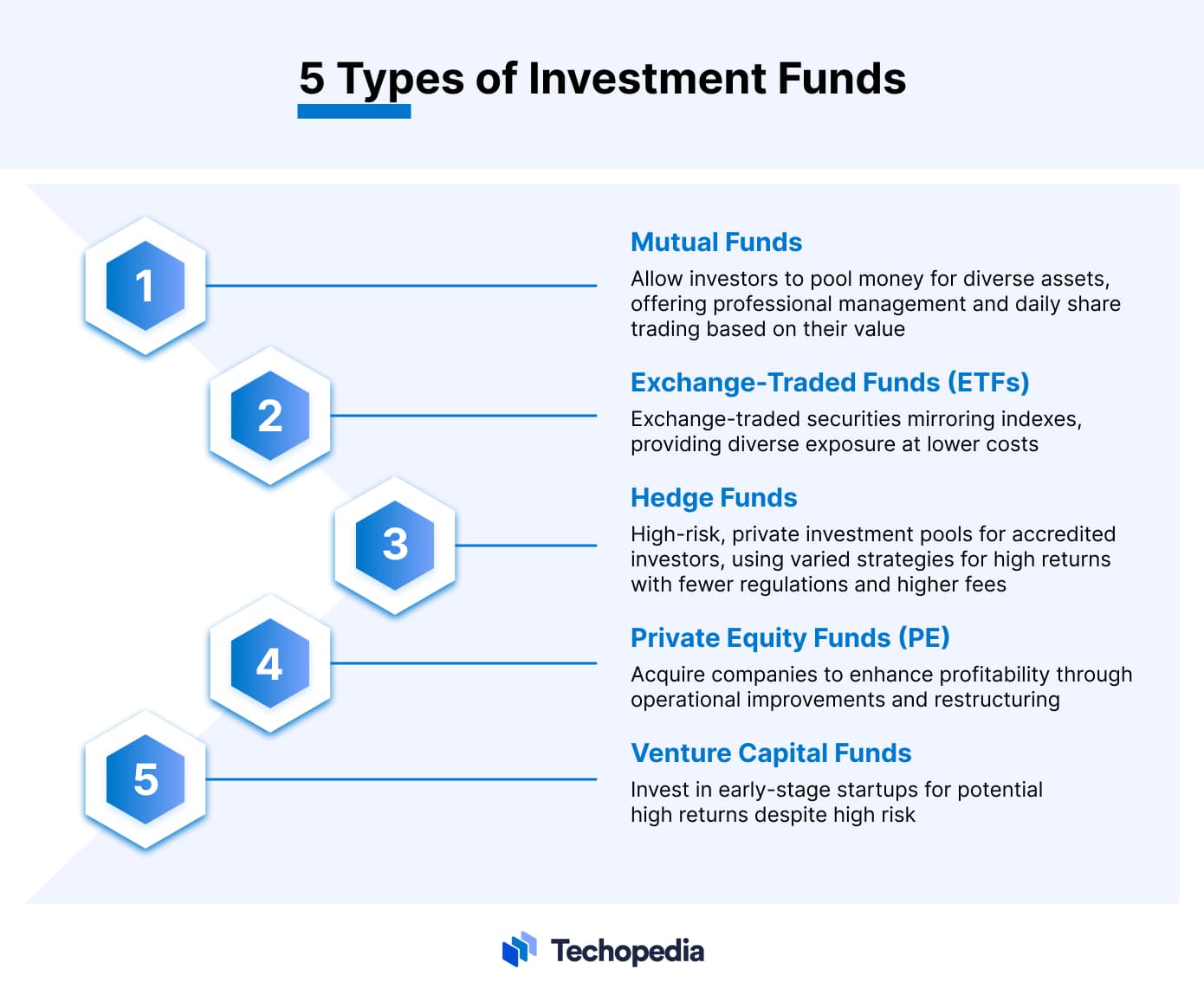

These are the five most common types of investment funds:

They allow investors to pool money in a fund that purchases a diverse portfolio of stocks, bonds, and other securities. They offer built-in diversification and professional management. Mutual funds sell and redeem shares directly with investors daily based on their net asset value (NAV).

ETFs are investment funds that trade intraday on stock exchanges like individual securities. ETFs track underlying indexes but trade at market prices which may deviate from their net asset value (NAV) at times. They offer diversified exposure to markets and often have lower costs than mutual funds.

Hedge funds are privately organized investment funds open only to accredited high-net-worth investors. They implement flexible investment strategies aimed at generating outsized returns through techniques like short selling, leverage, and derivatives trading. Hedge funds charge much higher fees and are less regulated than traditional funds.

These funds raise money from investors to acquire publicly traded companies to optimize their operations and, ultimately, raise their market value. Once the company has been restructured and its value has expanded, it exits the investment at a profit.

VC funds pour money into early-stage businesses – a.k.a. startups – that have created promising products, services, and business models. They take significant risks but tend to invest small amounts into a large number of different ventures to diversify their portfolios. Many of these investments will fail, but a handful will deliver outstanding returns that should make up for those that did not perform as expected.

In addition, there are industry-specific funds like real estate funds, commodity funds, and emerging market funds.

Funds can also be actively managed if the manager makes tactical bets or passively managed if they are designed to perform in the same way as a certain benchmark like the S&P 500 or Nasdaq 100 index.

Investment Funds Pros and Cons

Pros

- Professional management

- Diversification

- Economies of Scale

- Accessibility

- Liquidity

- Transparency

- Regulated structure

- Cost Efficiency

Cons

- Management fees

- Potential underperformance

- Lack of control

- Limited liquidity

- Tax inefficiency

- Market risk

- Regulatory limitations

- High Costs

Examples of Popular Investment Funds

Below are different categories of investment funds.

Mutual Funds

Exchange-Traded Funds

Hedge Funds

The Bottom Line

Investment funds allow individual investors to access professional asset management and portfolio diversification. By understanding the different fund types and the strategies they engage in to produce positive returns, investors can select the most appropriate funds aligned with their financial objectives and risk tolerance.

Maintaining a balanced portfolio with prudent fund selections helps mitigate the natural risks associated with investing in the financial markets.

FAQs

What is an investment fund in simple terms?

How do investment funds make money?

What is the most successful investment fund?

What is the difference between a mutual fund and an investment fund?

References

- Number of open-ended funds worldwide in the 2022, by fund type (Statista)

- The Closed-End Fund Market, 2022 (ICI)

- Vanguard 500 Index Fund Admiral Shares (Vanguard)

- Fidelity Magellan Fund (Fidelity)

- Blue Chip Growth Fund (T.RowePrice)

- SPDR S&P 500 ETF Trust (SSGA)

- Bridgewater Associates, LP (Whalewisdom)

- Medallion Fund: The Ultimate Counterexample? (Cornell Capital)